Menu

CALL FOR A FREE CONSULTATION

Exceptional Legal Representation Throughout

Long Island and New York, Since 1993.

CALL FOR A FREE CONSULTATION

Exceptional Legal Representation Throughout

Long Island and New York, Since 1993.

Tax Debt Negotiation Attorneys and Tax Settlement Lawyers – Nassau & Suffolk Counties, Brooklyn

Our attorneys work to negotiate tax agreements with the IRS and NYS to improve our clients’ financial situations.

Many individuals struggle to keep up with their tax payments to both the New York State Department of Taxation and Finance (NYS) and the U.S. Internal Revenue Service (IRS). These taxes include sales taxes, income taxes, payroll taxes, and other state and federal taxes. Fortunately, there are processes in place to settle the amounts owed to both governmental bodies. Our team can assist you in negotiating a tax debt settlement that will benefit your financial situation moving forward.

Many individuals struggle to keep up with their tax payments to both the New York State Department of Taxation and Finance (NYS) and the U.S. Internal Revenue Service (IRS). These taxes include sales taxes, income taxes, payroll taxes, and other state and federal taxes. Fortunately, there are processes in place to settle the amounts owed to both governmental bodies. Our team can assist you in negotiating a tax debt settlement that will benefit your financial situation moving forward.

In 2019, the IRS processed approximately 133,949,000 tax returns with around 76,000 employees, showcasing the massive workload the agency handles. Given this, it’s easy to understand why negotiating with the IRS can be challenging.

In 2019, the IRS processed approximately 133,949,000 tax returns with around 76,000 employees, showcasing the massive workload the agency handles. Given this, it’s easy to understand why negotiating with the IRS can be challenging.

The situation has become even more complicated due to delays caused by the COVID-19 pandemic. Although the IRS extended the tax deadline from April 15, 2020, to July 15, 2020, the agency remains significantly behind schedule. As a result, negotiating tax debt has become more difficult. However, our office is well-equipped with the necessary tools to confidently and efficiently negotiate on your behalf.

Notice of Levy:

Notice of Levy:

An IRS levy is a powerful enforcement tool that allows the IRS to take or freeze money from your bank accounts or other financial institutions, garnish your wages, and seize your property to satisfy your tax debt. In addition, the IRS can seize and sell personal assets such as vehicles and real estate.

If you have received a Final Notice of Intent to Levy and a Notice of Your Right to a Hearing, it is critical that you contact our office immediately. Compliance with IRS regulations is essential, and this notice represents the final step before the IRS takes action against you. Let us handle this situation for you.

Here are the IRS programs that our office will use to negotiate your tax liability:

Extension to Pay: These agreements give taxpayers an additional 120 days to pay off their IRS debt, helping avoid late fees.

72-Month Installment Agreements: These plans offer taxpayers up to six years (72 months) to repay their IRS debt. Taxpayers with balances up to $50,000 can apply for these plans, typically without the need for a complete financial statement, though the IRS may request supporting documents.

84-Month Installment Agreements: These plans provide taxpayers with seven years (84 months) to repay IRS debt. Available to those who owe more than $50,000 but less than $100,000, they also generally do not require a full financial statement, but the IRS may ask for documents. Additionally, automatic payments may be required.

Partial Pay Installment Agreements: These plans are for taxpayers who can’t afford the 72- or 84-month options. Based on your financial situation, you may qualify to pay less over time. While penalties and interest will still apply, the total debt may eventually be considered non-collectible after ten years due to the statute of limitations, and your payments may reduce. However, tax liens will be filed, and if your income increases, you may need to submit updated financial documents every 24 months.

Currently Non-Collectible (CNC): This option helps taxpayers who cannot pay any amount due to their financial situation. Financial statements are required, and while you do not make monthly payments, you must maintain this status through annual updates to your financial situation.

Offers in Compromise (OIC): This program allows taxpayers to settle their IRS debt for less than the full amount owed. The IRS will not accept an OIC if they believe the taxpayer can pay the debt in full or through an installment plan.

Discharging IRS Debt through Bankruptcy:

Discharging IRS Debt through Bankruptcy:

Income taxes are the only type of IRS debt that can be discharged in a Chapter 7 bankruptcy. Other taxes, such as payroll taxes, cannot be eliminated through bankruptcy. To discharge income tax debt, the following conditions must be met: the tax debt must be at least three years old, the taxpayer must have filed the necessary tax return, and the IRS must have assessed the debt more than 240 days prior to the bankruptcy filing.

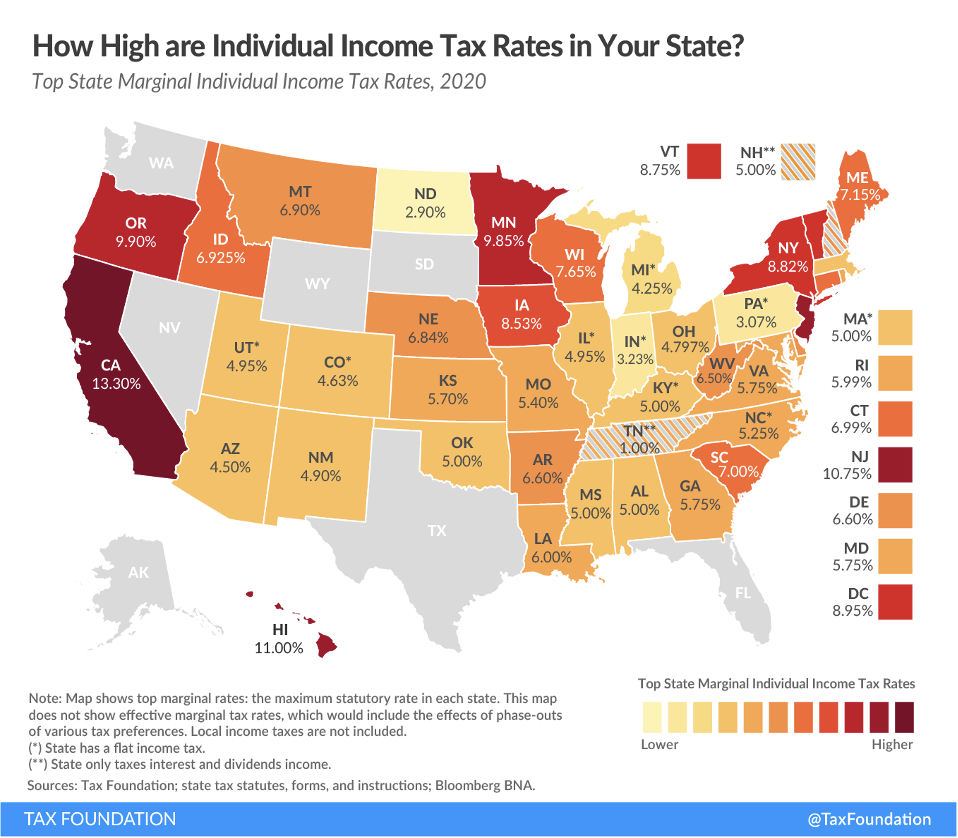

New York State has some of the highest taxes in the country, which can be a significant burden for many individuals, especially if there were errors in tax withholding or filing in the previous year. According to data from taxfoundation.org, New York has an average individual state income tax rate of 8.82%, highlighting the financial strain on residents. This is notably higher compared to states that do not impose state income taxes. Our summary will help you understand your tax obligations better.

New York State has some of the highest taxes in the country, which can be a significant burden for many individuals, especially if there were errors in tax withholding or filing in the previous year. According to data from taxfoundation.org, New York has an average individual state income tax rate of 8.82%, highlighting the financial strain on residents. This is notably higher compared to states that do not impose state income taxes. Our summary will help you understand your tax obligations better.

New York Tax Warrants: A tax warrant in New York is equivalent to a civil judgment against a taxpayer and is the state’s initial enforcement tool. Before enforcing tax obligations, the state must issue this warrant. Afterward, the state may garnish your wages and seize and sell personal or real assets. The proceeds from any seized assets will be used to pay off your debt. To check if you have a tax warrant, visit the New York State Tax Warrant Notice System.

A tax warrant in New York is equivalent to a civil judgment against a taxpayer and is the state’s initial enforcement tool. Before enforcing tax obligations, the state must issue this warrant. Afterward, the state may garnish your wages and seize and sell personal or real assets. The proceeds from any seized assets will be used to pay off your debt. To check if you have a tax warrant, visit the New York State Tax Warrant Notice System.

Levies:

After a tax warrant is issued, a levy may be placed on one or more of your bank accounts, including joint accounts. A levy freezes your account, preventing you from accessing your money until the tax liability is resolved with the state.

Income Execution Orders:

New York State may issue an income execution before or after filing a tax warrant. You must make the first payment within twenty (20) days of receiving the notice. The income execution orders that 10% of your gross income or 25% of your disposable earnings be withheld. Use the Income Execution Payment Calculator to calculate your payment.

Seizures:

If other enforcement measures fail, the state may move to seize your property. This includes cars, business assets, or cash registers. Seizure is allowed under New York Civil Practice Laws and Rules Article 52 (CPLR Article 52).

Driver’s License Suspension:

If you owe New York State at least $10,000 in unpaid taxes, the NYS Tax Department can request the suspension of your driver’s license. You’ll receive a Notice of Proposed Suspension with sixty (60) days to pay off the debt. If unresolved, the DMV will be contacted to suspend your license.

However, exceptions apply for individuals with commercial driver’s licenses (CDLs), those receiving Supplemental Security Income (SSI), paying child or spousal support, having wages garnished, or receiving public assistance benefits.

New York State Offset Programs:

If you owe money to the IRS, NYS Tax Department, another NYS agency, or any other state, New York State can apply your state refund to settle those debts.

Money Exempt from Enforcement:

Funds that are exempt from NYS tax enforcement include Social Security, Supplemental Security Income, public assistance, spousal support, alimony, child support, unemployment benefits, disability, workers’ compensation, and pensions.

Installment Payment Agreement (IPA):

Installment Payment Agreement (IPA):

Taxpayers with a balance of $20,000 or less have the option to use an Installment Payment Agreement (IPA) to spread their payments over time through the NYS Taxation Department. These agreements are allowed in New York State but are limited to a maximum duration of 36 months, which is about half the duration of IRS installment agreements.

Offer in Compromise (OIC):

Qualified taxpayers facing financial hardship may settle significant tax debts through a New York State Offer in Compromise. The state may consider insolvent taxpayers eligible for this option, as long as they haven’t filed for bankruptcy or closed their business. If taxpayers are solvent but would experience undue financial hardship in paying the full debt, the state will assess this possibility.

Undue hardship is defined as being unable to cover reasonable living expenses. Our office will advocate on your behalf, highlighting any mitigating circumstances such as age, work history, employment status, long-term illnesses, medical conditions, or disabilities that contribute to your financial hardship. Additionally, we may argue special cases, including unique educational costs, medical emergencies, or natural disasters. We will also consider whether selling assets or borrowing money is a viable solution. Going forward, we may use the financial impacts of COVID-19 as a special circumstance to support your case, given its significant and unpredictable effects on taxpayers’ financial situations.

You have the legal right to contest or object to any bill or notice you receive from the NYS Tax Department. Our office can assist you in several ways with this process.

Informal Protest:

The quickest and most cost-effective method to protest is through informal means, which our office can handle with your consent. If you wish to challenge the bill or notice, we will engage with the NYS Tax Department on your behalf.

Formal Protest:

Our office can also petition for a Tax Appeal hearing or request a conciliation conference. In these situations, we will act as your advocate, defending your rights and interests to the fullest.

The enforcement of tax debt is what sets NY tax debt apart from IRS tax debt. If you owe unpaid federal taxes, the Internal Revenue Service will likely seize any tax refund you receive. While New York State can take similar action, the impact is typically less significant, as state tax refunds tend to be much smaller than federal ones. However, New York State has stricter enforcement measures that can more directly affect your daily life. For instance, driver’s licenses in New York are considered a privilege, not a right, and can be easily revoked for violations. While the IRS can suspend your passport, it is not a common occurrence, and lawsuits over passport issues are rare.

The enforcement of tax debt is what sets NY tax debt apart from IRS tax debt. If you owe unpaid federal taxes, the Internal Revenue Service will likely seize any tax refund you receive. While New York State can take similar action, the impact is typically less significant, as state tax refunds tend to be much smaller than federal ones. However, New York State has stricter enforcement measures that can more directly affect your daily life. For instance, driver’s licenses in New York are considered a privilege, not a right, and can be easily revoked for violations. While the IRS can suspend your passport, it is not a common occurrence, and lawsuits over passport issues are rare.

For more details on enforcement actions, check our NY Tax Enforcement section. New York may issue tax warrants, levies, income execution orders, and seizures, which are similar to the IRS’s Notice of Levy. Additionally, securing an installment agreement is more challenging in New York, where you are given only thirty-six months to pay the debt, compared to the IRS’s seventy-two and eighty-four-month plans.

If you’ve never filed taxes before, your best option is to have our office apply for the NYS Tax Department’s Voluntary Disclosure and Compliance Program on your behalf. By doing so, you can avoid financial penalties and potential criminal charges. We’ll inform the state of the taxes you owe and your commitment to paying them. If you’re unable to pay in full upfront, we can help set up a repayment plan for the back taxes. Lastly, to join this program, you’ll need to agree to pay all future taxes as they come due.

If you’ve never filed taxes before, your best option is to have our office apply for the NYS Tax Department’s Voluntary Disclosure and Compliance Program on your behalf. By doing so, you can avoid financial penalties and potential criminal charges. We’ll inform the state of the taxes you owe and your commitment to paying them. If you’re unable to pay in full upfront, we can help set up a repayment plan for the back taxes. Lastly, to join this program, you’ll need to agree to pay all future taxes as they come due.

Do you believe your property taxes are too high? Are you paying more than you should because your property was valued incorrectly? Our office can help you challenge your property valuation to potentially reduce your taxes. We’ll represent you before the Board of Assessment Review (BAR), which consists of individuals selected by local village, town, or city boards. Together, we’ll present compelling arguments and provide supporting documentation to demonstrate why you deserve a reduction in your property assessment.

Do you believe your property taxes are too high? Are you paying more than you should because your property was valued incorrectly? Our office can help you challenge your property valuation to potentially reduce your taxes. We’ll represent you before the Board of Assessment Review (BAR), which consists of individuals selected by local village, town, or city boards. Together, we’ll present compelling arguments and provide supporting documentation to demonstrate why you deserve a reduction in your property assessment.

Under Chapter 7 bankruptcy, certain New York State debts, such as payroll taxes, sales taxes, and other fiduciary taxes, cannot be discharged. These types of taxes involve the business owner holding tax funds on behalf of third parties, and they cannot be eliminated through bankruptcy. For income tax debts to be discharged, they must meet the following criteria: they must be at least three years old, the IRS must have assessed the debt more than 240 days before the bankruptcy filing, and the tax return associated with the debt must be filed correctly, without any fraud allegations.

Under Chapter 7 bankruptcy, certain New York State debts, such as payroll taxes, sales taxes, and other fiduciary taxes, cannot be discharged. These types of taxes involve the business owner holding tax funds on behalf of third parties, and they cannot be eliminated through bankruptcy. For income tax debts to be discharged, they must meet the following criteria: they must be at least three years old, the IRS must have assessed the debt more than 240 days before the bankruptcy filing, and the tax return associated with the debt must be filed correctly, without any fraud allegations.

Our law office offers exceptional negotiation skills, allowing us to secure a wide range of favorable outcomes for clients. While most tax negotiation firms, accountants, and attorneys are skilled negotiators, we have an edge. We can demonstrate to creditors—either directly or indirectly—that individuals or business owners have viable options for litigation and bankruptcy. This additional leverage gives us valuable “cards to play,” helping us negotiate a better deal on your behalf.

Our law office offers exceptional negotiation skills, allowing us to secure a wide range of favorable outcomes for clients. While most tax negotiation firms, accountants, and attorneys are skilled negotiators, we have an edge. We can demonstrate to creditors—either directly or indirectly—that individuals or business owners have viable options for litigation and bankruptcy. This additional leverage gives us valuable “cards to play,” helping us negotiate a better deal on your behalf.

We begin by meeting with you to understand your background, objectives, and challenges. During the first consultation, we will discuss the available options and alternatives to help you navigate what can be a complex situation. If you decide to proceed with our services, we will conduct an intake to gather further information and documentation from you. Upon hiring us, we will sign a retainer agreement that outlines the specifics of our engagement.

We begin by meeting with you to understand your background, objectives, and challenges. During the first consultation, we will discuss the available options and alternatives to help you navigate what can be a complex situation. If you decide to proceed with our services, we will conduct an intake to gather further information and documentation from you. Upon hiring us, we will sign a retainer agreement that outlines the specifics of our engagement.

Please contact us at 631-250-4120 for a free legal consultation regarding resolving tax debt owed to the IRS and/or NYS.

Our Consultations are Free, but Our Legal Advice May be Invaluable.

Negotiation

We start by obtaining Power of Attorney (POA) authority to file or update tax filings, gather transcripts, and ensure your records are current. We will identify the years and types of taxes due, as well as the amounts owed. Our team will explain why you need our services and how we successfully close deals.

Defense

We handle a variety of appeals and cases, including personal liability defenses such as the Innocent Spouse Defense and the Statute of Limitations. We also work to reduce penalties and interest, and may argue that you are not personally liable or that you were not an officer in charge.

Bankruptcy

We offer options for bankruptcy, including SDNY rulings and mediation, new cases, and relaxed standards. We specialize in Chapter 7, 13, and 11 bankruptcy filings.

NYS – Same Approach

For New York State, we will gather the necessary information, negotiate on your behalf, and explore options similar to the IRS, based on their guidelines and statements.

How We Assist Our Clients

We focus on providing real-life case studies, examining the debt incurred, helping clients close deals, and determining the necessary documentation. Our strategies are aimed at getting the best results, including helping clients outrun the Statute of Limitations (SOL).

TAXES (Additional Outline)

TAXES (Additional Outline)

What Taxes: Explanation of taxes levied by both the IRS and NYS, detailing how fraud, error, or failure to file can result in owing money.

Negotiation in General

This section addresses general tax negotiations:

This comprehensive approach ensures we explore every avenue for the best possible outcome in your tax debt resolution.

MONDAY – FRIDAY -8.30 AM – 8.30 PM