Menu

CALL FOR A FREE CONSULTATION

Exceptional Legal Representation Throughout

Long Island and New York, Since 1993.

CALL FOR A FREE CONSULTATION

Exceptional Legal Representation Throughout

Long Island and New York, Since 1993.

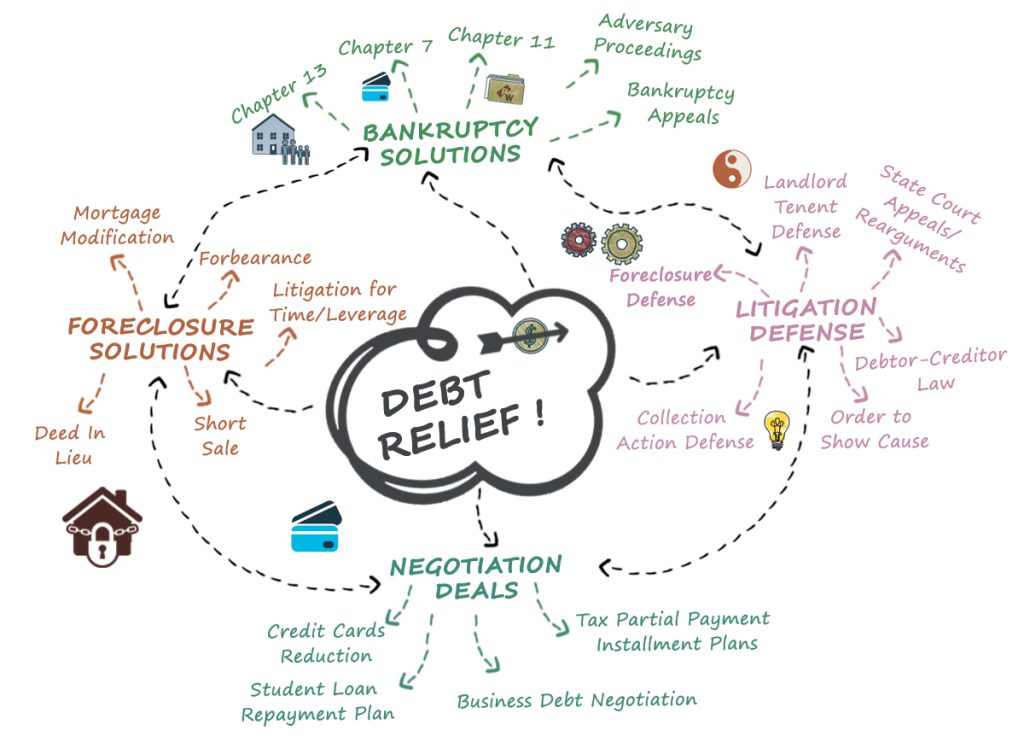

The Law Office of Ronald D. Weiss P.C. is dedicated to assisting Long Island clients with debt relief by helping them eliminate, reduce, extend, and/or restructure nearly all types of debt. We provide a wide range of legal services, all focused on offering diverse solutions or “tools” to address our clients’ financial struggles. Our debt relief services are available as standalone options or in combination, tailored to strategically resolve our clients’ economic challenges. These debt relief “tools” include, but are not limited to: various forms of bankruptcy (Chapters 7, 11, and 13), foreclosure defense, landlord-tenant litigation, general debt litigation, mortgage modification, creditor negotiations, credit card settlements, tax debt repayment plans, business debt restructuring, student loan repayment agreements, short sales, real estate transactions, and credit repair.

We are attorneys representing residents of Nassau & Suffolk Counties, LI with legal solutions to overwhelming debt and foreclosure.

The Law Office of Ronald D. Weiss, P.C. specializes in bankruptcy (Chapters 7, 11, & 13), foreclosure defense litigation, mortgage loan modification, creditor negotiations and settlements, and general debt relief. Our primary office is located on Route 110, at the Nassau County and Suffolk County border, in Melville, Long Island, NY. Since our establishment in 1993, we have assisted numerous individuals and businesses facing financial struggles and mortgage challenges across Long Island and the greater New York area. Our team of attorneys and legal assistants are highly experienced, compassionate, and committed to supporting clients through times of financial difficulty. We focus on the following areas:

The Law Office of Ronald D. Weiss, P.C. specializes in bankruptcy (Chapters 7, 11, & 13), foreclosure defense litigation, mortgage loan modification, creditor negotiations and settlements, and general debt relief. Our primary office is located on Route 110, at the Nassau County and Suffolk County border, in Melville, Long Island, NY. Since our establishment in 1993, we have assisted numerous individuals and businesses facing financial struggles and mortgage challenges across Long Island and the greater New York area. Our team of attorneys and legal assistants are highly experienced, compassionate, and committed to supporting clients through times of financial difficulty. We focus on the following areas:

Bankruptcy Solutions utilize federal bankruptcy laws and courts to provide immediate protection for individuals and businesses against creditors, enabling debt elimination under Chapter 7 or debt reorganization through Chapter 13 (primarily for individuals) and Chapter 11 (mainly for businesses). We typically employ Bankruptcy Solutions when clients are overwhelmed by unsecured debts, such as credit cards, medical bills, and personal loans, or require time to address and/or modify secured debts like mortgage and car loan arrears. The automatic stay, which halts creditor actions including bank restraints, wage garnishments, and foreclosure sales, goes into effect as soon as a bankruptcy case is filed. Specialized bankruptcy services, such as defending against contested motions and adversary proceedings, allow us to assist clients in more complex bankruptcy cases, while bankruptcy appeals enable us to seek a review of bankruptcy court decisions that we believe were made in error. Bankruptcy Solutions are often the most reliable and efficient means of resolving difficult debt issues, ultimately helping restore our clients’ financial health and credit.

Bankruptcy Solutions utilize federal bankruptcy laws and courts to provide immediate protection for individuals and businesses against creditors, enabling debt elimination under Chapter 7 or debt reorganization through Chapter 13 (primarily for individuals) and Chapter 11 (mainly for businesses). We typically employ Bankruptcy Solutions when clients are overwhelmed by unsecured debts, such as credit cards, medical bills, and personal loans, or require time to address and/or modify secured debts like mortgage and car loan arrears. The automatic stay, which halts creditor actions including bank restraints, wage garnishments, and foreclosure sales, goes into effect as soon as a bankruptcy case is filed. Specialized bankruptcy services, such as defending against contested motions and adversary proceedings, allow us to assist clients in more complex bankruptcy cases, while bankruptcy appeals enable us to seek a review of bankruptcy court decisions that we believe were made in error. Bankruptcy Solutions are often the most reliable and efficient means of resolving difficult debt issues, ultimately helping restore our clients’ financial health and credit.

Mortgage Modifications help resolve our clients’ mortgage loan arrears by restructuring the loan to offer better payment terms, such as lower interest rates, a longer repayment period, and potentially a partial deferral of the principal. Essentially, these modifications aim to reorganize the mortgage principal to include the arrears, with improved terms to keep the monthly payment the same or slightly lower than it was before the arrears accumulated. Mortgage modifications are the primary way property owners attempt to maintain ownership of their property and are considered the main Retention Option. Mortgage negotiations are divided into Retention Options, which aim to keep the property, and Non-Retention Options, which involve giving up the property in exchange for other benefits. In addition to modifications, other Retention Options include Friendly Sales, Friendly Short Sales, Refinancing, Payoff or Short Payoff, and/or Reinstatement or Short Reinstatement. Non-Retention Options include Third-Party Sales, Short Sales, Deed in Lieu agreements, Consent to Judgment, and Cash for Keys agreements. The goal of these agreements is to reach a favorable arrangement with the lender that helps the property owner achieve their objectives.

Mortgage Modifications help resolve our clients’ mortgage loan arrears by restructuring the loan to offer better payment terms, such as lower interest rates, a longer repayment period, and potentially a partial deferral of the principal. Essentially, these modifications aim to reorganize the mortgage principal to include the arrears, with improved terms to keep the monthly payment the same or slightly lower than it was before the arrears accumulated. Mortgage modifications are the primary way property owners attempt to maintain ownership of their property and are considered the main Retention Option. Mortgage negotiations are divided into Retention Options, which aim to keep the property, and Non-Retention Options, which involve giving up the property in exchange for other benefits. In addition to modifications, other Retention Options include Friendly Sales, Friendly Short Sales, Refinancing, Payoff or Short Payoff, and/or Reinstatement or Short Reinstatement. Non-Retention Options include Third-Party Sales, Short Sales, Deed in Lieu agreements, Consent to Judgment, and Cash for Keys agreements. The goal of these agreements is to reach a favorable arrangement with the lender that helps the property owner achieve their objectives.

Negotiation Solutions involve direct negotiations with a client’s creditors to reduce, reorganize, and/or extend debts such as credit card debt, student loans, medical bills, business-related debts, and tax obligations. Credit Card Settlements are negotiated agreements with unsecured creditors to settle overdue credit card debt for a significantly reduced lump sum or through affordable installment payments. Tax debt negotiations, student loan negotiations, and business loan negotiations aim to establish payment plans that are manageable and help clients take advantage of statute of limitations periods, ultimately reducing the amount of debt owed. Negotiation Solutions are designed to give clients a strategic advantage, significantly increasing the likelihood of reaching a favorable settlement with their creditors.

Negotiation Solutions involve direct negotiations with a client’s creditors to reduce, reorganize, and/or extend debts such as credit card debt, student loans, medical bills, business-related debts, and tax obligations. Credit Card Settlements are negotiated agreements with unsecured creditors to settle overdue credit card debt for a significantly reduced lump sum or through affordable installment payments. Tax debt negotiations, student loan negotiations, and business loan negotiations aim to establish payment plans that are manageable and help clients take advantage of statute of limitations periods, ultimately reducing the amount of debt owed. Negotiation Solutions are designed to give clients a strategic advantage, significantly increasing the likelihood of reaching a favorable settlement with their creditors.

Landlord-Tenant Defense typically takes place in local Landlord-Tenant Courts and is often needed when a home is lost to foreclosure, allowing the former homeowner more time before they must vacate. We represent both landlords and tenants in eviction proceedings and actions to collect rent in landlord-tenant court. Additionally, residential and commercial tenants often require representation when facing challenges in negotiating or litigating their lease agreements. Owners of cooperative apartments or townhouses may also need to defend their proprietary lease in Landlord-Tenant Court.

Landlord-Tenant Defense typically takes place in local Landlord-Tenant Courts and is often needed when a home is lost to foreclosure, allowing the former homeowner more time before they must vacate. We represent both landlords and tenants in eviction proceedings and actions to collect rent in landlord-tenant court. Additionally, residential and commercial tenants often require representation when facing challenges in negotiating or litigating their lease agreements. Owners of cooperative apartments or townhouses may also need to defend their proprietary lease in Landlord-Tenant Court.

Litigation Defense involves defending our clients in state courts against various collection actions, including disputes over credit card debt, personal loans, tax debt, business loans, student loans, medical bills, and other obligations. Litigation is often used to delay a resolution in favor of the plaintiff in a debt collection case, providing the defendant with time and leverage to seek a settlement. We handle and defend, or initiate, most commercial litigation, with a focus on debt defense, challenging the validity of the debt, the evidence supporting it, the collection methods used, and/or the litigation procedures. Defending debt through litigation may not only render the debt uncollectible but also serves as a valuable tool in helping us better manage debt on behalf of our clients.

Litigation Defense involves defending our clients in state courts against various collection actions, including disputes over credit card debt, personal loans, tax debt, business loans, student loans, medical bills, and other obligations. Litigation is often used to delay a resolution in favor of the plaintiff in a debt collection case, providing the defendant with time and leverage to seek a settlement. We handle and defend, or initiate, most commercial litigation, with a focus on debt defense, challenging the validity of the debt, the evidence supporting it, the collection methods used, and/or the litigation procedures. Defending debt through litigation may not only render the debt uncollectible but also serves as a valuable tool in helping us better manage debt on behalf of our clients.

Our New York attorneys assist clients in the following towns with foreclosure, modification, negotiation, and bankruptcy services: In Suffolk County, NY, we represent residents of Huntington, Islip, Smithtown, Brookhaven, Babylon, East Hampton, Southampton, Southold, Riverhead, and Shelter Island. In Nassau County, we serve clients in Oyster Bay, Glen Cove, Hempstead, North Hempstead, and Long Beach. Our main office is located at 445 Broadhollow Road, Suite CL-10, Melville, NY 11747, where we conduct business regularly. Additionally, we have several branch offices in Nassau and Suffolk Counties, as well as Queens and Brooklyn, New York, which are available by appointment only.

Our New York attorneys assist clients in the following towns with foreclosure, modification, negotiation, and bankruptcy services: In Suffolk County, NY, we represent residents of Huntington, Islip, Smithtown, Brookhaven, Babylon, East Hampton, Southampton, Southold, Riverhead, and Shelter Island. In Nassau County, we serve clients in Oyster Bay, Glen Cove, Hempstead, North Hempstead, and Long Beach. Our main office is located at 445 Broadhollow Road, Suite CL-10, Melville, NY 11747, where we conduct business regularly. Additionally, we have several branch offices in Nassau and Suffolk Counties, as well as Queens and Brooklyn, New York, which are available by appointment only.

When it comes to debt-related issues, we stand unmatched in providing debt relief, solutions, and resolutions. Our firm is structured into specialized departments, each tackling debt challenges from different angles—negotiation, litigation, modification, and/or bankruptcy. Each department brings a wealth of experience and a variety of approaches to debt solutions. This allows us to handle straightforward debt matters efficiently, while also offering exceptional, customized solutions for more complex and challenging cases, all at an affordable rate. In addition to our expertise and ability to work cost-effectively at a high level, we are a friendly, warm, and quirky team that truly enjoys working with our clients. As a result, you’ll likely have a great experience with us, despite the challenges you’re facing. Together, we can turn “life’s lemons” into “lemonade” by resolving your debt and legal issues, putting you in a better position.

When it comes to debt-related issues, we stand unmatched in providing debt relief, solutions, and resolutions. Our firm is structured into specialized departments, each tackling debt challenges from different angles—negotiation, litigation, modification, and/or bankruptcy. Each department brings a wealth of experience and a variety of approaches to debt solutions. This allows us to handle straightforward debt matters efficiently, while also offering exceptional, customized solutions for more complex and challenging cases, all at an affordable rate. In addition to our expertise and ability to work cost-effectively at a high level, we are a friendly, warm, and quirky team that truly enjoys working with our clients. As a result, you’ll likely have a great experience with us, despite the challenges you’re facing. Together, we can turn “life’s lemons” into “lemonade” by resolving your debt and legal issues, putting you in a better position.

The Law Office of Ronald D. Weiss, P.C. was formed in 1993, by Ronald D. Weiss, Esq., a debt relief attorney, who since becoming a member of the New York State Bar in 1988 has been committed to representing. The Law Office of Ronald D. Weiss, P.C. was formed in 1993, by Ronald D. Weiss, Esq., a debt relief attorney, who since becoming a member of the New York State Bar in 1988 has been committed to representing County and County clients seeking debt relief.

The Law Office of Ronald D. Weiss, P.C. was formed in 1993, by Ronald D. Weiss, Esq., a debt relief attorney, who since becoming a member of the New York State Bar in 1988 has been committed to representing. The Law Office of Ronald D. Weiss, P.C. was formed in 1993, by Ronald D. Weiss, Esq., a debt relief attorney, who since becoming a member of the New York State Bar in 1988 has been committed to representing County and County clients seeking debt relief.

We are conveniently located by the A/C/4/5 lines. Depending on your location, take the subway from a station near you. Board the A, C, or 2 train heading towards Brooklyn.

Disembark at the Court Street-Borough Hall Station.

Walk southwest on Joralemon Street toward Court Street.

Turn right onto Court Street, and 26 Court Street will be on your right.

Subway from Lower Manhattan:

If you’re in Lower Manhattan, you can take the 4 or 5 train towards Brooklyn.

Disembark at the Borough Hall Station.

Walk south on Court Street toward Remsen Street.

26 Court Street will be on your right.

Start by heading west on I-495 W (Expressway) toward Brooklyn/Manhattan.

Start by heading west on I-495 W (Expressway) toward Brooklyn/Manhattan.

Merge onto I-278 W/Brooklyn Queens Expressway W via the ramp to Staten Island.

Take exit 29 to merge onto Tillary Street toward Manhattan Bridge/Brooklyn Civic Center.

Turn left onto Jay Street, and then turn right onto York Street.

Continue onto Gold Street, and finally, turn left onto York Street.

Turn right onto Bridge Street, and then turn left onto.

Continue onto Gold Street, and finally, turn left onto Court Street. You will find 26 Court Street on your right.

Head southeast on the route that takes you to the Brooklyn Bridge.

Cross the Brooklyn Bridge and continue onto Adams Street.

Turn left onto York Street, and then turn right onto Gold Street.

Turn left onto, continue onto Gold Street, and finally, turn left onto Court Street. 26 Court Street will be on your right.

Via Brooklyn Battery Tunnel (I-478 S):

Head southwest on the route that takes you to the Brooklyn Battery Tunnel.

Take the exit toward I-278 W/Staten Island/Brooklyn.

Merge onto I-278 W/Brooklyn Queens Expressway W.

Take exit 29 for Tillary Street toward Manhattan Bridge/Brooklyn Civic Center.

Turn left onto Jay Street, and then turn right onto York Street.

Continue onto Gold Street, and finally, turn left onto York Street.

Turn right onto Bridge Street, and then turn left onto.

Continue onto Gold Street, and finally, turn left onto Court Street. 26 Court Street will be on your right.

Thank you. Words can not express the relief I feel right now. I have been running like a fugitive. I really don't know what to do next. Thank you for all your work and your time. I don't know if I owe you anything right now but if I do please give time to get on my feet again. Thank you again.

CR, McKinney, TexasThank you. Words can not express the relief I feel right now. I have been running like a fugitive. I really don't know what to do next. Thank you for all your work and your time. I don't know if I owe you anything right now but if I do please give time to get on my feet again. Thank you again.

CR, McKinney, TexasMONDAY – FRIDAY -8.30 AM – 8.30 PM

We are conveniently located by the A/C/4/5 lines. Depending on your location, take the subway from a station near you. Board the A, C, or 2 train heading towards Brooklyn.

Disembark at the Court Street-Borough Hall Station.

Walk southwest on Joralemon Street toward Court Street.

Turn right onto Court Street, and 26 Court Street will be on your right.

Subway from Lower Manhattan:

If you’re in Lower Manhattan, you can take the 4 or 5 train towards Brooklyn.

Disembark at the Borough Hall Station.

Walk south on Court Street toward Remsen Street.

26 Court Street will be on your right.

Thank you. Words can not express the relief I feel right now. I have been running like a fugitive. I really don't know what to do next. Thank you for all your work and your time. I don't know if I owe you anything right now but if I do please give time to get on my feet again. Thank you again.

CR, McKinney, Texas