Menu

CALL FOR A FREE CONSULTATION

Exceptional Legal Representation Throughout

Long Island and New York, Since 1993.

CALL FOR A FREE CONSULTATION

Exceptional Legal Representation Throughout

Long Island and New York, Since 1993.

Tax Debt Negotiation Attorneys and Tax Settlement Lawyers – Brooklyn and Queens

Our experienced tax attorneys work to negotiate favorable tax agreements with the IRS and New York State (NYS) to help clients resolve their tax debts and improve their financial situation.

Many individuals struggle to keep up with their tax obligations to the New York State Department of Taxation and Finance (NYS)—which includes sales taxes, income taxes, payroll taxes, and other state taxes—as well as the U.S. Internal Revenue Service (IRS)—which oversees individual income taxes, corporate income taxes, payroll taxes, and other federal taxes.

Many individuals struggle to keep up with their tax obligations to the New York State Department of Taxation and Finance (NYS)—which includes sales taxes, income taxes, payroll taxes, and other state taxes—as well as the U.S. Internal Revenue Service (IRS)—which oversees individual income taxes, corporate income taxes, payroll taxes, and other federal taxes.

Since tax debt impacts both taxpayers and government agencies, programs exist to negotiate and settle outstanding tax liabilities. Our team can work with you to develop a customized tax debt settlement plan that aligns with your financial situation and helps you move forward.

The Internal Revenue Service (IRS) reported that in 2019, it processed approximately 133,949,000 tax returns with a workforce of about 76,000 employees. These figures highlight the immense workload the IRS handles annually, making negotiations with the agency particularly complex.

The Internal Revenue Service (IRS) reported that in 2019, it processed approximately 133,949,000 tax returns with a workforce of about 76,000 employees. These figures highlight the immense workload the IRS handles annually, making negotiations with the agency particularly complex.

Due to COVID-19, the IRS experienced significant delays. The tax deadline was extended from April 15, 2020, to July 15, 2020, but even with this extension, the agency fell behind its usual schedule. As a result, negotiating tax debt has become more challenging.

Despite these difficulties, our office has the expertise and resources to effectively negotiate on your behalf, helping you navigate IRS procedures with confidence and ease.

An IRS levy is a powerful enforcement tool that allows the IRS to:

An IRS levy is a powerful enforcement tool that allows the IRS to:

If you have received a Final Notice of Intent to Levy and a Notice of Your Right to a Hearing, it is critical to take immediate action. This is the last step before the IRS moves forward with enforcement.

Compliance with the IRS is crucial. Contact our office as soon as possible so we can handle the situation on your behalf and help protect your assets.

Our office employs various IRS programs to negotiate and resolve your tax liability. Below are the available options:

Extension to Pay

72-Month Installment Agreement

84-Month Installment Agreement

Partial Pay Installment Agreement

Currently Non-Collectible (CNC) Status

Offer in Compromise (OIC)

If you need assistance determining the best IRS resolution method for your situation, contact our office for guidance and representation.

Discharging IRS Debt Through Bankruptcy

Discharging IRS Debt Through Bankruptcy

Only income taxes can be discharged in a Chapter 7 bankruptcy; other types of IRS debt, such as payroll taxes, cannot be eliminated through bankruptcy.

To qualify for an income tax debt discharge, the following conditions must be met:

If you are struggling with IRS tax debt, our office can evaluate your eligibility for discharge through bankruptcy and guide you through the process.

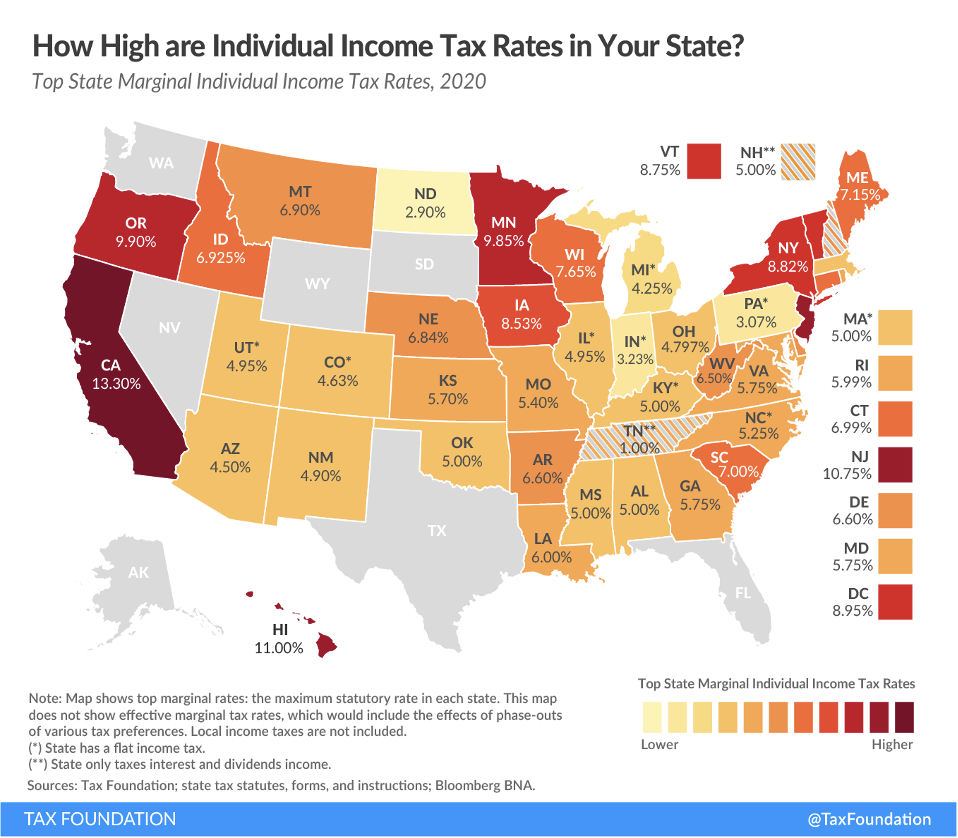

New York State has some of the highest taxes in the country, creating financial challenges for many residents—especially those who experienced improper tax withholding or filing issues in previous tax years.

New York State has some of the highest taxes in the country, creating financial challenges for many residents—especially those who experienced improper tax withholding or filing issues in previous tax years.

According to TaxFoundation.org, New York ranks among the top states for high tax rates, with an average individual state income tax rate of 8.82%. This places a significant financial burden on residents, especially when compared to states that do not impose state income taxes.

If you’re struggling with NYS tax debt, our office can help you understand your tax obligations and work toward negotiating a resolution that fits your financial situation.

New York Tax Warrants

A New York Tax Warrant functions as a civil judgment against a taxpayer and serves as the state’s first step in enforcing tax collection. Before New York State can take action to recover unpaid taxes, a tax warrant must be issued. Once in place, the state can:

A New York Tax Warrant functions as a civil judgment against a taxpayer and serves as the state’s first step in enforcing tax collection. Before New York State can take action to recover unpaid taxes, a tax warrant must be issued. Once in place, the state can:

To check whether a tax warrant has been issued against you, visit the New York State Tax Warrant Notice System.

Levies

Once a tax warrant is in effect, New York State can issue a levy on your bank accounts. This applies to both individual and joint accounts, even if the co-owner is not responsible for the tax debt. Access to your funds will be restricted until the tax liability is resolved.

Income Execution Orders

New York State can issue an Income Execution Order before or after filing a tax warrant. If you receive this notice, you must make the first payment within 20 days. Payments will be deducted from your wages as follows:

To estimate your potential payment, use the Income Execution Payment Calculator.

Seizures

If other collection methods fail, New York State may seize your property under New York Civil Practice Laws and Rules Article 52 (CPLR Article 52). This includes:

For more information, refer to CPLR Article 52.

Driver’s License Suspension

If you owe $10,000 or more in unpaid NYS taxes, the state can request the suspension of your driver’s license. You will receive a Notice of Proposed Driver’s License Suspension, giving you 60 days to settle your tax debt before New York State contacts the Department of Motor Vehicles (DMV) to enforce the suspension.

Exceptions: Your driver’s license will not be suspended if you:

New York State Offset Programs

If you owe money to entities such as the IRS, NYS Tax Department, other NYS agencies, or another state, New York State may redirect your NYS tax refund to cover these debts.

Money Exempt from Enforcement

Certain income and assets are protected from NYS tax enforcement, including:

If you’re facing NYS tax enforcement actions, our office can help you explore negotiation options and work toward a manageable resolution.

Installment Payment Agreement (IPA):

Installment Payment Agreement (IPA):

Certain funds and assets are exempt from New York State tax enforcement, including Supplemental Security and Social Security income, public assistance programs such as welfare, spousal support, alimony, and child support. Additionally, unemployment benefits, disability payments, workers’ compensation, and pensions are also protected.

Offer in Compromise (OIC):

Taxpayers facing financial hardship may qualify for a New York State Offer in Compromise to settle substantial tax liabilities. The state considers insolvent taxpayers eligible, as well as those who have not declared bankruptcy or closed their business. If a solvent taxpayer would experience undue financial hardship by paying the full debt, the state will review their case. Undue economic hardship occurs when a taxpayer cannot meet reasonable living expenses.

We will present all relevant mitigating factors to demonstrate that full payment of your tax liability would cause severe financial distress. Factors such as age, employment history, work status, long-term illnesses, medical conditions, or disabilities will be used to support your case. Additionally, we may argue undue hardship due to unique educational expenses, medical emergencies, or natural disasters. Other potential considerations include the inability to take on additional debt or liquidate assets to settle tax obligations.

Our office will also advocate for COVID-19 to be recognized as a special circumstance due to its unpredictable and widespread financial impact on taxpayers.

You have the legal right to dispute or challenge any bill or notice issued by the NYS Tax Department. Our office is here to assist you in navigating this process.

Informal Protest:

The fastest and most cost-effective way to contest a bill or notice is through an informal protest, which our office can handle on your behalf with your authorization. If you wish to challenge the notice, we will communicate directly with the NYS Tax Department to present your case.

Formal Protest:

If necessary, our office can file a petition for a Tax Appeal hearing or request a conciliation conference. In both cases, we will serve as your dedicated advocate, vigorously defending your rights and financial interests.

The primary distinction between NYS tax debt and IRS tax debt lies in their enforcement methods. If you owe federal taxes, the IRS will likely seize any tax refund you receive. While New York State can take similar action, the impact is usually less severe since state tax refunds are generally smaller than federal refunds. However, New York enforces tax debt more aggressively and has more direct means to affect your daily life.

The primary distinction between NYS tax debt and IRS tax debt lies in their enforcement methods. If you owe federal taxes, the IRS will likely seize any tax refund you receive. While New York State can take similar action, the impact is usually less severe since state tax refunds are generally smaller than federal refunds. However, New York enforces tax debt more aggressively and has more direct means to affect your daily life.

In New York, a driver’s license is a privilege, not a right, and can be revoked for non-compliance with tax laws. While the IRS has the authority to suspend passports, legal action over this matter is less common. Additionally, New York State may issue income execution orders, tax warrants, levies, and asset seizures—methods similar to an IRS Notice of Levy. For more details on these enforcement strategies, refer to our section on NY Tax Enforcement.

Lastly, securing an installment agreement is more challenging in New York. The state allows only 36 months to repay tax debt, whereas the IRS offers longer installment plans of 72 or 84 months.

If you have never filed taxes before, the best course of action is to have our office apply for the NYS Tax Department’s Voluntary Disclosure and Compliance Program on your behalf. This program allows you to avoid financial penalties and potential criminal charges.

If you have never filed taxes before, the best course of action is to have our office apply for the NYS Tax Department’s Voluntary Disclosure and Compliance Program on your behalf. This program allows you to avoid financial penalties and potential criminal charges.

Through this process, we will notify the state of any outstanding taxes you owe and ensure they are properly addressed. If you are unable to pay the full amount immediately, we can arrange a repayment plan to help you settle your tax debt over time. Additionally, participation in this program requires a commitment to staying compliant and paying all future taxes.

Do you believe your property taxes are too high? Are you overpaying due to an incorrect property valuation? Our office can help you seek a property valuation adjustment to lower your tax burden.

Do you believe your property taxes are too high? Are you overpaying due to an incorrect property valuation? Our office can help you seek a property valuation adjustment to lower your tax burden.

We will assist you in challenging your property assessment by representing you before the Board of Assessment Review (BAR), which consists of members appointed by village, town, or city boards. To support your case for a reduced assessment, we will present compelling arguments along with the necessary documentation.

The only New York State tax debts that cannot be discharged under Chapter 7 bankruptcy are payroll taxes, sales taxes, and other fiduciary taxes, where a business owner holds tax funds on behalf of third parties. Since fiduciary taxes, such as sales and payroll taxes, are collected on behalf of others, bankruptcy cannot eliminate them.

The only New York State tax debts that cannot be discharged under Chapter 7 bankruptcy are payroll taxes, sales taxes, and other fiduciary taxes, where a business owner holds tax funds on behalf of third parties. Since fiduciary taxes, such as sales and payroll taxes, are collected on behalf of others, bankruptcy cannot eliminate them.

To qualify for the discharge of income tax debt, the following conditions must be met:

Our office excels in negotiation, offering a wide range of potential resolutions for your tax debt. While tax negotiation companies, accountants, and attorneys may have strong negotiation skills, we bring an added advantage.

Our office excels in negotiation, offering a wide range of potential resolutions for your tax debt. While tax negotiation companies, accountants, and attorneys may have strong negotiation skills, we bring an added advantage.

We leverage our ability to demonstrate—explicitly or implicitly—to creditors that the taxpayer or business owner has legal options, including litigation and bankruptcy. By strategically using these options as bargaining tools, we can secure a more favorable negotiated outcome on your behalf.

We begin by meeting with you to understand your background, objectives, and financial challenges. During your initial consultation, we will outline potential options and strategies to help resolve your tax debt. If you choose to proceed with our services, we will conduct a detailed intake process to gather additional information and required documentation. Upon engagement, we will formalize our agreement through a retainer contract detailing the scope of our services.

We begin by meeting with you to understand your background, objectives, and financial challenges. During your initial consultation, we will outline potential options and strategies to help resolve your tax debt. If you choose to proceed with our services, we will conduct a detailed intake process to gather additional information and required documentation. Upon engagement, we will formalize our agreement through a retainer contract detailing the scope of our services.

For a free legal consultation on resolving tax debt with the IRS and/or NYS, call 631-212-1046.

For a free legal consultation on resolving tax debt with the IRS and/or NYS, call 631-212-1046.

Our Consultations Are Free, But Our Legal Advice May Be Invaluable

Negotiation

Defense Strategies

Bankruptcy Options

NYS and IRS Tax Debt Resolution

We handle both IRS and NYS tax debt cases while ensuring compliance with their specific regulations and guidelines.

Key Aspects of Tax Debt Resolution

Our firm leverages strong negotiation skills, legal expertise, and strategic litigation options to help clients achieve the best possible resolution for their tax debt.

MONDAY – FRIDAY -8.30 AM – 8.30 PM